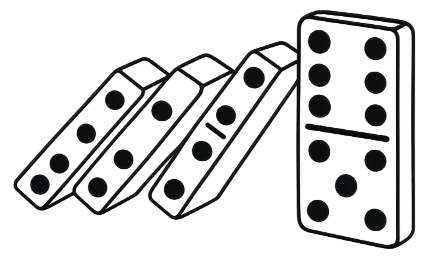

A property chain is a series of property transactions where each buyer’s purchase depends on each seller completing their sale – like a domino effect. If one sale is delayed or falls through, it can impact the entire chain.

How Does It Work?

Bottom of the chain: a buyer with nothing to sell (e.g first-time buyer).

Middle of the chain: buyers who need to sell their current property before purchasing a new one.

Top of the chain: Sellers who don’t need to buy another property (e.g inherited home).

How Does a Chain Affect You as a Seller?

If your buyer needs to sell their property before purchasing yours, there’s a risk that their sale could fall through — and in turn, cause your sale to collapse. This can be stressful, especially if you’re relying on the proceeds to buy your next home.

House sales can collapse for many reasons such as:

- Mortgage application being rejected.

- Poor survey results revealing serious issues with the property.

- Change of mind.

Can you get a Chain-Free Sale?

Yes! There are many properties with no chain involved which is highly desirable. This typically happens when the property is vacant (like an inherited home), or when the buyer is an investor or first-time buyer.

Are There Ways to Protect Your Sale & Minimise Chain Risks?

Keep your documents organised – sign and return paperwork to your solicitor as soon as possible.

Communication – stay updated with your solicitor about any progression with your chain.

Choose a serious buyer – you could look for buyers who already have a mortgage in principle in place or have already sold their property so are chain-free.

Choose a good conveyancer – they will save you time and money in the long term.

In Summary…

While you can’t control everything in a property chain and that can be frustrating, taking the right steps early can help you move with greater confidence.

Are you thinking about selling? Simply Move Home can help make your property journey as smooth and stress-free as possible!